Brazil hails US tariff rollback as ‘significant progress' and seeks more exemptions

Brazil's Vice President Geraldo Alckmin says U.S. President Donald Trump's decision to remove additional import tariffs on some Brazilian agribusiness products marks significant progress

November 21, 2025

All the delicious ways you can reduce food waste in the kitchen

All the delicious ways you can reduce food waste in the kitchen

Couple carries on late son's legacy of public service

Couple carries on late son's legacy of public service

Tunisia frees prominent lawyer Sonia Dahmani, a critic of the president

Tunisia frees prominent lawyer Sonia Dahmani, a critic of the president

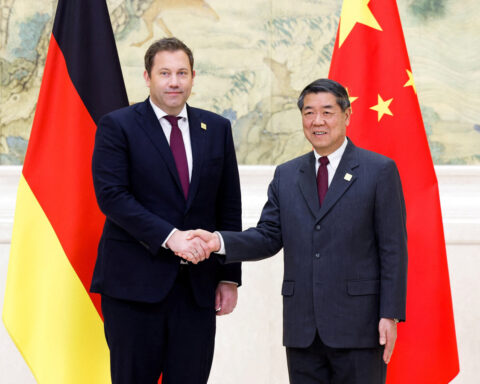

Putin sees US peace plan as a starting point as he warns Ukraine's army to withdraw

Putin sees US peace plan as a starting point as he warns Ukraine's army to withdraw

Putin says it's senseless to sign documents with 'illegitimate' Ukrainian leadership

Putin says it's senseless to sign documents with 'illegitimate' Ukrainian leadership

Dutch prosecutor fines Morgan Stanley 101 million euros for tax evasion

Dutch prosecutor fines Morgan Stanley 101 million euros for tax evasion

Sally Rooney says UK ban on Palestine Action could force her books off shelves

Sally Rooney says UK ban on Palestine Action could force her books off shelves